01/10/2024

The Automotive and Equipment Finance industry continues to evolve.

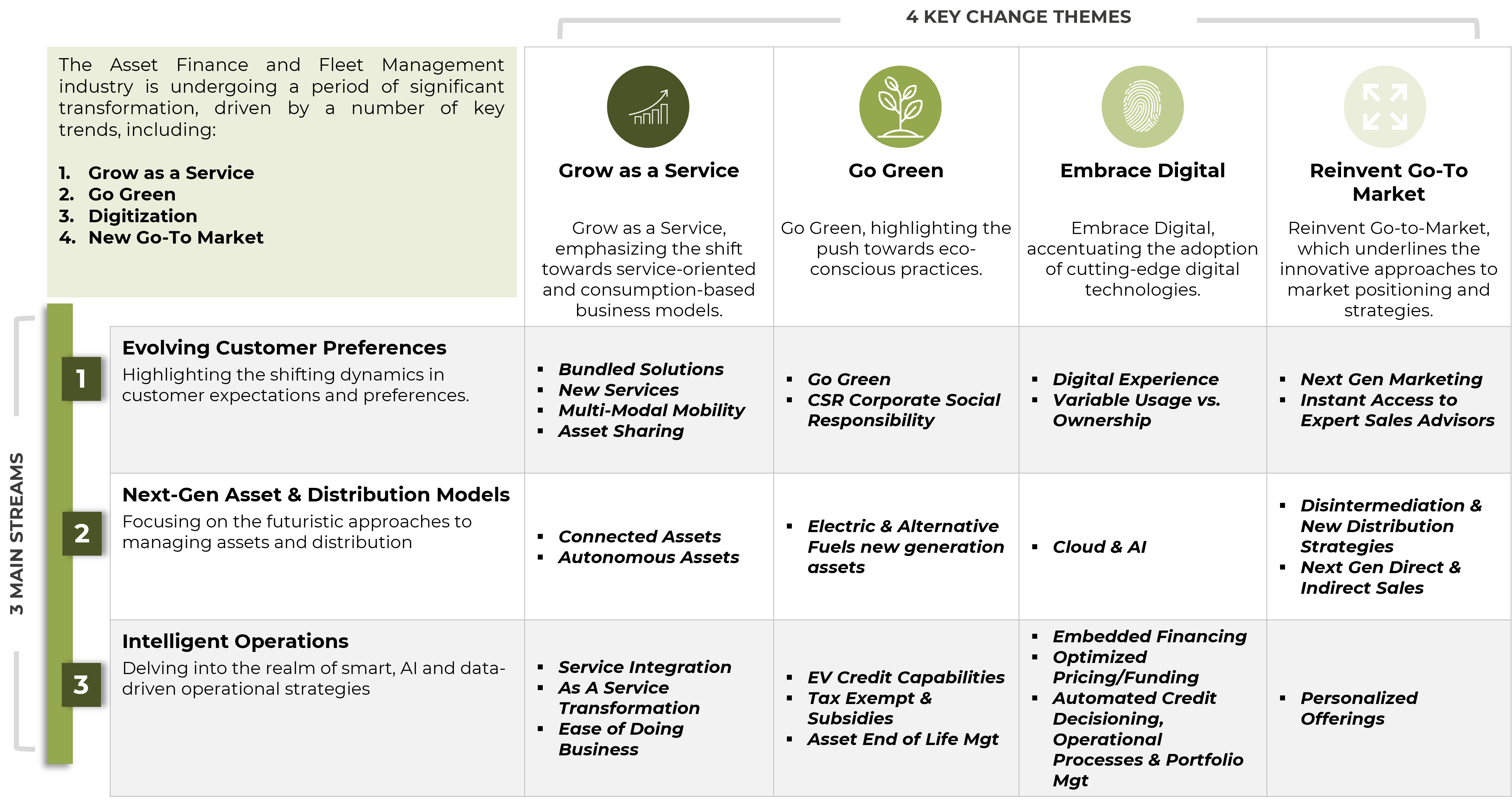

Several trends, such as electrification, agency model, and as-a-service, to name a few, are deeply and quickly transforming the Automotive and Equipment Finance industries. Explore four change themes and three key streams summarizing the shifts in the current market identified by Teamwill’s experts. What can you and your company do to keep up?

Adapt to the market shift, or risk being phased out:

In the current market, Teamwill has identified four change themes and three key streams in Automotive and Equipment Finance trends.

3 Main Streams in Automotive and Equipment Finance Trends

Our approach to categorizing automotive trends results in the emergence of three significant streams.

Evolving Customer Preferences,

which highlights the shifting dynamics in customer expectations and preferences.

Next-Gen Asset & Distribution Models,

focusing on the futuristic approaches to managing assets and distribution.

Intelligent Operations,

delving into the realm of smart, AI and data-driven operational strategies.

4 Key Themes underpinning Automotive and Equipment Finance Trends

To further enhance the clarity and depth of our exploration, we’ve classified these streams into four pivotal themes that serve as the thematic pillars underpinning our analysis.

Grow As A Service

Grow as a Service, emphasizing the shift towards service-oriented and consumption-based business models

Go Green

Go Green, highlighting the push towards eco-conscious practices

Embrace Digital

Embrace Digital, accentuating the adoption of cutting-edge digital technologies

Go-To Market

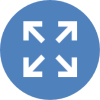

How Teamwill helps Automotive and Equipment Finance customers reimagine their future:

We’ve designed a roadmap to navigate the rapidly changing business landscape, marked by evolving customer preferences, new asset and distribution models, and the rise of intelligent operations. This environment demands a transformation, including new business models and enhanced customer experiences, supported by advanced technology.

We help our customers thrive through this transformation by combining our expertise in business, processes, solutions, and technology.

Business Model

Develop new business models to sustain growth and improve future profitability

Customer Experience

Reimagine the customer journeys and interactions to offer a premier experience

New Business Capabilities

Develop new business capabilities to increase performance and competitiveness

Technology

Deploy innovative high impact technology to support transformation

Teamwill: Your partner of choice for Asset Finance and Lending

Teamwill provides a deep and broad expertise on all aspects of lending with our 4 pillars.

Integrated in the core business of our clients

Our unique focus on the financial services industry allows us to develop a deep business expertise:

- Equipment finance

- Auto finance

- Corporate lending

- Retail lending

- Trade finance and factoring

Development along the entire Value Chain

We cover the entire lending value chain and bring tools and accelerators:

- Products, marketing and sales

- Origination and credit

- Servicing and client management

- Finance and accounting

Comprehensive Expertise in Solution Implementation and Integration

We know and have implemented most of the LOS and Lending platforms:

- Expert team

- Tailored solutions

- Implementation expertise

Enhancing Lending Solutions with Critical Components

We leverage our extensive technical capabilities to design and build the best system architectures:

- Data intelligence

- Automation

- Intelligent integration

- Payments

- Multi-channel communication

- Cloud

Teamwill: Your partner of choice for Asset Finance and Lending:

Teamwill provides a deep and broad expertise on all aspects of lending with our 4 pillars of expertise.

Business Expertise

Integrated in the core business of our clients

Our unique focus on the financial services industry allows us to develop a deep business expertise:

- Equipment finance

- Auto finance

- Corporate lending

- Retail lending

- Trade finance and factoring

Value Chain Expertise

Development along the entire Value Chain

We cover the entire lending value chain and bring tools and accelerators:

- Products, marketing and sales

- Origination and credit

- Servicing and client management

- Finance and accounting

Solution Expertise

Comprehensive Expertise in Solution Implementation and Integration

We know and have implemented most of the LOS and Lending platforms:

- Expert team

- Tailored solutions

- Implementation expertise

Technical Expertise

Enhancing Lending Solutions with Critical Components

We leverage our extensive technical capabilities to design and build the best system architectures:

- Data intelligence

- Automation

- Intelligent integration

- Payments

- Multi-channel communication

- Cloud

Why Teamwill?

We have

expertise

For over 20 years, we have been assisting clients in transforming their credit, financing, services and asset management operations.

We provide

value

We offer excellent value for money, ensuring customers get more benefits and quality for their investment.

We keep

innovating

We continuously innovate to help our customers leverage new technologies to adapt to market trends.

We are

flexible

We prioritize adaptability, providing our customers with extreme flexibility to navigate and adjust to constantly changing conditions.

We are

commited

+70% of our tasks/projects are carried out on a fixed price basis or in teams.

Let’s connect!

We would love to connect with you to discuss the many opportunities for improving the performance of your business. Please reach out for an initial discovery meeting to identify short-term business improvements or for our corporate presentation.

Zied Bach Hamba

Managing Director Teamwill US

Linkedin Account

Share this article: